HSG

2021 Highlights

Hi Sun Global's Year in Review: Our 2021 Highlights

2021 has been a monumental year for Fin-Tech giant Hi Sun Global (HSG). HSG gained various accolades recognizing its groundbreaking work in providing cloud-based core banking solutions in the digital space. The China-based Fin-Tech Company shaped much of the 2021 core banking sector with comprehensive approaches that serve as a benchmark to native computing cloud-based banking entrants.

The 2021 track has been bright for HSG and its affiliates, offering groundbreaking technology to tier one banks in China and Asia. With the year just ended, it will be prudent to review the highs and lows the transformative company underwent.

Easing Into the New Year

In 2020, HSG expanded its territories and tapped the wider Asian market. The bold move paid off as many banks and other financial institutions integrated HSG’s systems into their mainstream finance modules.

The market reach surpassed Hi Sun Global’s expectations as the company managed to ease into European economic zones. Heading into 2021, the company aimed to build on the success of a fruitful year in terms of product absorption and customer base.

Banking Tech of the Year

HSG’s highlight award was in the Asia Fin-Tech 2021 awards, where we scooped the Banking Tech of The Year award for their groundbreaking work in digital banking. The wards out HSG against its key competitors in the Asia Fin-Tech market.

Hi Sun Global edged its peers due to its customer-centric approach to developing custom solutions for the banking sector across Asia.

Other solutions HSG comprehensively offers are:

- Core Banking

- e-Banking

- e-Langing

- e-KYC

- AML

- Payment

- Fraud Detection

- Reporting

- Channel Integrator

Tailored solutions, especially the engagement of Software as a Service (SaaS) integrations to provide unified payment systems, is one of the revolutionary efforts the Fin-Tech corporate partook in to earn accolades. The Banking Tech of The Year award is the most notable recognition of the many HSG attained.

海外 及其他地区

As the pandemic affected the world economy, bankers faced a tough call. To juggle between providing reliable banking services and loan delinquencies, HSG had to overcome. The economic downturn during the pandemic and the bold move to enter new markets made the challenge even more arduous.

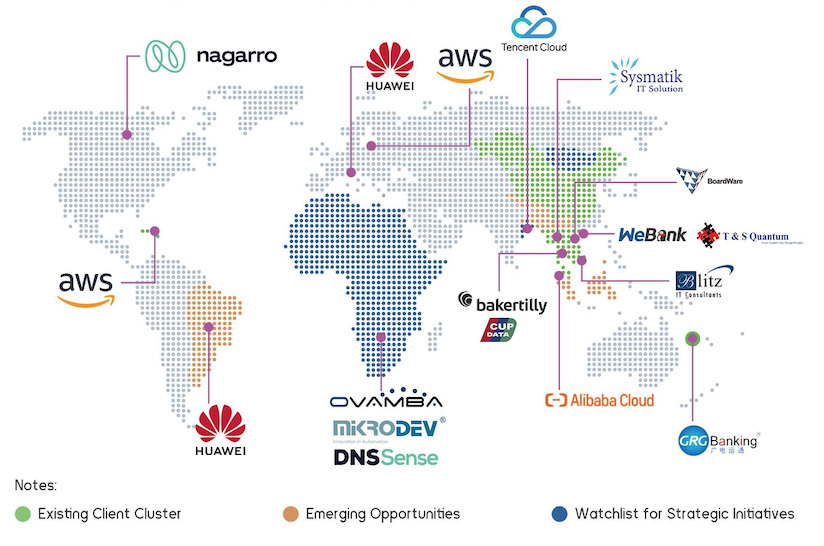

However, when the going gets tough, the tough get going and vice versa. HSG shifters to virtual marketing to increase the customer base and engage prospective clients on offering cutting-edge banking tech. We can proudly say we have over 50 overseas banks using our core banking system. But it’s only the tip of the iceberg to what we can accomplish with continuous innovation in providing Fintech solutions.

But HSG couldn’t do it alone. Forging partnerships to introduce next-generation core banking technologies to the retail and corporate sectors was a major driving force.

One of the major partners to come on board is BCEL, Laos’ largest bank. BCEL approached HSG to replace the legacy core banking system. It was the initial step into entering the Laos market, which is prime for digitalizing the existing banking system. We collaborated with our BCEL partners to launch core banking solution products for retail and corporate banking.

HSG collaborated efforts with BCEL bank yielded:

-

A core banking system replacement -

Versatile banking products -

Powerful channel integrator that enables API for scalable growth

Another highly influential partner in our success in Laos is our global partner, Sysmatik IT solutions. The partnership formed in October 2021 chief aim was to introduce robust banking products that offer the end-user a more rewarding banking experience.

With the pandemic’s effects significantly economical, individuals and investors turned to banks for an olive branch to blunt the economic hardships. The administrative burden for legacy banking systems caused lags in service delivery. Our HSG customer-centric solutions improved end-to-end banking through the alliance and eased the administrative load through AI-based AML technology. The partnership has conferred significant benefits to Laotians, and efforts are underway to proliferate the success on a global scale.

In line with the aim of Asia, Europe, and then Africa, HSG Fintech solutions will continue to provide digital solutions through forming partnerships with the best-in-class regards digital banking. “We have a 100% success rate for our core banking system. Through each partnership, we always come out with a better understanding of the market, the way people adapt and communicate, and how we can refine our products and services to create a truly customer-centric experience that also boosts operational efficiency. Our end-to-end solutions take care of everything from our direct partners to their clients and their clients’ friends and families. This has created an entire ecosystem that we want to service and support through the road to digitalization,” said Sisi Yu, the general manager of HSG.

提升柬埔寨数字银行业务

新维度

HSG partnered with China UnionPay Data Services (CUPD) to engage Asian-Pacific Development (ADP) bank in Cambodia to popularize digital banking in Cambodia. HSG’S cutting-edge technology powered ADP’s efforts to offer leading-edge services on an advanced international standard.

The revolutionary approach merged standard API to increase collaboration and exponential growth, automation of regulatory compliance, and preconfigured functions for product offerings. Our symbiotic relationship with ADP served as the guide to other Cambodian banks who approached us to upgrade their banking systems to international standards.

The Oriental bank obtained full licensing from the National Bank of Cambodia and speedily adapted to HSG solutions. The rapid digitalization of their banking system saw a 60% hybrid digital and 40% conventional banking system established.

The idea is to provide digital services to the growing customer base while offering legacy banking services to clients who prefer a brick-and-mortar banking experience. The end-to-end delivery of the Hi Sun Banking Suite (HBS) system made the strategy a functioning reality.

We Participated in

出席多类金融科技活动To sharpen our knowledge of digital banking, we participated in various fin-tech events such as the 6th Hong Kong Fintech Week. The events provided useful insights as to the ever-increasing customer needs. We aim to use the data gathered to further our efforts in improving user experience in the digital banking sector.

Other global events we participated in, including virtual and physical, are the Asian Financial Forum (Jan), Retail Banking Conference (May), and HKTDC organized webinars. Our core value as a company is focusing on the people. The Fintech events provided an engaging platform to seek our clients’ first-hand feedback.

我们为供应链金融数字银行

提供开发支持

China Brilliant Global Limited partnered with us to venture into the little-known aspect of the supply chain in finance. Our team of experts from all over the world synergized their efforts to provide next-gen digital banking with a core emphasis on providing customers with a one-stop platform for supply chain finance. The main modules of next-gen digital banking are:

- Fast and efficient enterprise online account opening process

- Innovative virtual banking solutions

- Multi-system cloud deployment solutions

- Overall solution for banking systems.

China Brilliant Global Limited and HSG bridged the real economy and digital banking gap. Most of the projects are in infancy, but the data shows the robust modules are already improving digital banking in the economic sector.

Next-Gen Mortgage Solutions

Back home, another HK lender benefited from our custom solutions. The HK lender has been at the forefront of developing cutting-edge products to meet the evolving financial needs of a growing customer base. However, challenges impede the progress to providing exceptional and real-time banking service. Migration from conventional loan processing to digital, low speed to launch new products, and lack of resources to execute projects in the pipeline were significant challenges until HSG stepped into the frame.

Through our services, we managed to:

- Developed a faster integrative loan platform

- Automate mortgage services

The result is an enhanced customer experience. Also, faster propagation of products to existing and new users will be a major boost for the company’s lending services.

Scaling and Beyond

Our core banking system plays an essential role in digitalizing banking. However, it is not limited to providing operational efficiency in Asia and our overseas clients. Our Dev ops team made full use of cloud computing to offer a scalable HBS system focusing on microservices support, globalization support, and downsizing migration.

Downsizing increases application usability while still maintaining the same full use of cloud computing. In its own light, it is a revolutionary technology that we mastered in 2021.

HSG continues to power customers’ services with low-cost, high-impact downsizing migrations that increase the business’s innovative knack.

The partnership with InvestHK (Sep 2021), another Fintech corporation, aims to scale Hong Kong and beyond opportunities using high technology banking systems such as our core banking system.

...As I look back on the last year, our business had achieved substantial growth despite the pandemic resulting from joint efforts working with our clients and partners. We saw a number of important contracts signed, collaborations started, and milestones reached in our long-term journey of growth...

Ms Sisi Yu

General Manager, HiSun Global

”

Outlook

In 2022 we will continue to improve the digital space in banking for retail and corporate stakeholders. We continue to make significant investments in our technology to enhance the customer banking experience. HSG will continue to be your trusted Technology Partner by leading the way to digital transformation.

高阳寰球亮相2024年华为全联接大会

2024年华为全联接大会于9月19日在上海盛大开幕,本次大会以“共赢行业智能化”为主题,从战略、产业、生态等多方面探讨如何通过智能化、数字化技术赋能千行百业,抓住新机遇,共赢智能未来。展区规模达4万平方米,展示了众多创新产品及解决方案,充分展现了科技如何推动各行业的智能化转型。

高阳寰球云栖大会展示数智化方案,助力AI时代金融行业变革

9月19日,以“云启智跃,产业蝶变”为主题的2024云栖大会在杭州开幕。大会为期三天,聚焦AI时代的云计算升级,设有三大主论坛、400多个分论坛,并开放4万平方米的展区,展示全球百余款AI应用。作为中国云计算产业的年度盛会,云栖大会自2009年起已举办15届,见证了云计算发展的重要时刻。